The liquid staking ecosystem of Ethereum has grown to be one of the largest success stories in the DeFi sector to date. With a TVL of over $46 billion on Ethereum alone, the ability to restake your ETH and increase your capital efficiency throughout Ethereum’s DeFi ecosystem has been massively useful and one of the few examples of genuine utility occurring in the crypto industry.

Lido and Rocket Pool have led the way for years, amassing a market share of over 75% percent at the time of writing. Until recently, liquid staking had stagnated as a narrative as users had become accustomed to the utility of stETH - users began to participate heavily again after Eigenlayer, a native restaking protocol for ETH, began opening up deposits, growing to over $12 billion in TVL as of writing this.

Eigenlayer is a protocol that lets users deposit liquid staking tokens like stETH or rETH in return for restaked ETH in return, a new type of liquid staking token that lets users earn native staking yield and additional yield from Eigenlayer’s range of actively validated services (AVSs) simultaneously. With Eigenlayer having just recently launched mainnet, it’s as good of a time as any to dig in and gain an understanding of how restaking can benefit a broad AVS ecosystem and better align decentralized application security. As of writing this there are a handful of AVSs that have gone live on Eigenlayer - AltLayer’s Xterio and Mach, Lagrange, Brevis and Witness Chain. The beauty of AVSs lies in the simplicity Eigenlayer offers in spinning up a network and bootstrapping security from a reliable - and massive - pool of capital. All of these AVSs might offer entirely differentiated services, but they are all together under the umbrella of restaking provided by Eigenlayer.

The goal of this report will be to analyze not only Eigenlayer and its ambitious plans, but the host of other liquid restaking token (LRT) protocols that have been gaining traction in anticipation of the possibilities of widespread restaking. The protocols examined are three of the categorical leaders working on LRTs and additional functionality - EtherFi, Renzo and Puffer Finance. These protocols have managed to attract over $4 billion in TVL and have displayed no signs of slowing down anytime soon, with frequent collaborations and partnerships releasing every single day.

With a goal of becoming the most widely utilized and accessible restaking layer for Ethereum and beyond, Eigenlayer has been working hard to integrate more AVSs and expand its ecosystem. The architecture behind Eigenlayer can appear to be quite complicated, though it’s a lot more simple after breaking down its core parts.

At the heart of Eigenlayer is its restaking functionality, where Eigenlayer is able to gain temporary control over stETH and its accompanying security features by rewarding users with increased yields as opposed to native staking with Lido or Rocket Pool. By enabling its ecosystem of actively validated services to share in Ethereum’s robust security, Eigenlayer has essentially created a platform where protocols are able to avoid the problem of bootstrapping security and can instead focus on what truly matters - building a successful protocol.

Looking at the restaking ecosystem

There are many protocols involved in the wild west of restaking, though our focus today is only covering three of the major players offering LRTs - there will be some discussion of protocols like Pendle and the role they play in incentivizing LRTs and enabling yield generation opportunities, but this concept is far too detailed to be covered in just one section. Instead, we’ll use these protocols and Pendle as an example of what’s possible with restaking and how it might lead to a revival in DeFi.

EtherFi

EtherFi is a protocol offering decentralized liquid staking and more recently restaking via its LRT, eETH. Users can stake their ETH within EtherFi and earn staking rewards while automatically restaking that same ETH within Eigenlayer. EtherFi is a robust wrapper protocol that makes the process of restaking far easier for its users, abstracting away many of the difficulties around yield management and liquidity provision.

EtherFi has a TVL of over $3.8 billion and is the categorical liquid restaking leader currently on the market. The success of Eigenlayer sparked significant interest amongst the DeFi community thanks to Eigenlayer’s point incentivization program, adding an innovative twist to the traditional process of airdrops in crypto. For the uninformed, many crypto protocols and infrastructure providers like Uniswap, Arbitrum and Jito Labs have airdropped early users tokens in an effort to decentralize supply and reward community members.

More recently, some projects have taken to the idea of rewarding users with points prior to the actual airdrop, creating entirely new markets where users are more informed of their yield thanks to the denomination changing to a set ratio of points to capital deposited. This has led to the immense growth of DeFi protocol Pendle Finance, with its TVL having grown from $200 million at the start of 2024 to over $4.8 billion - arguably the most successful growth story of crypto since last cycle.

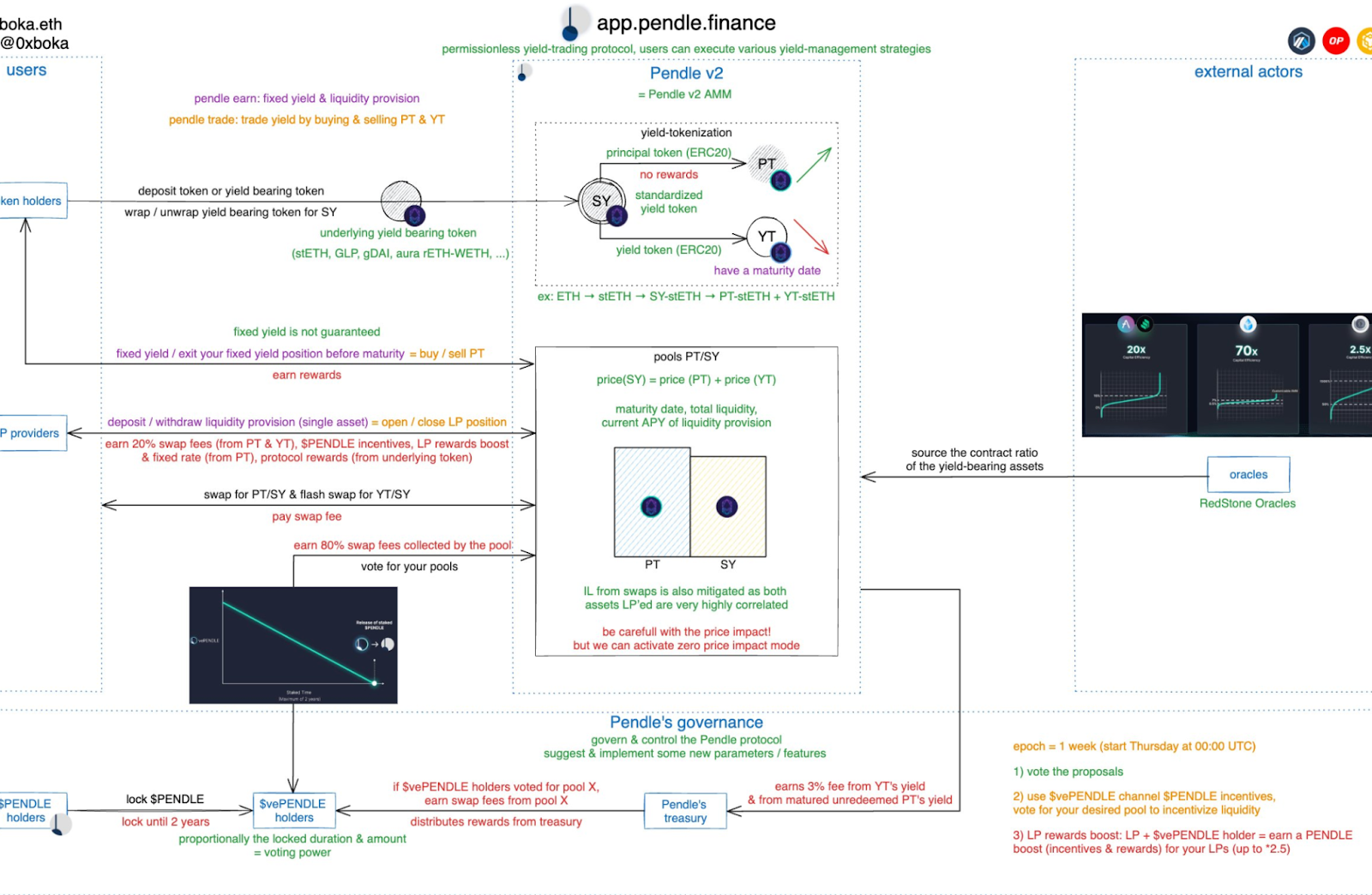

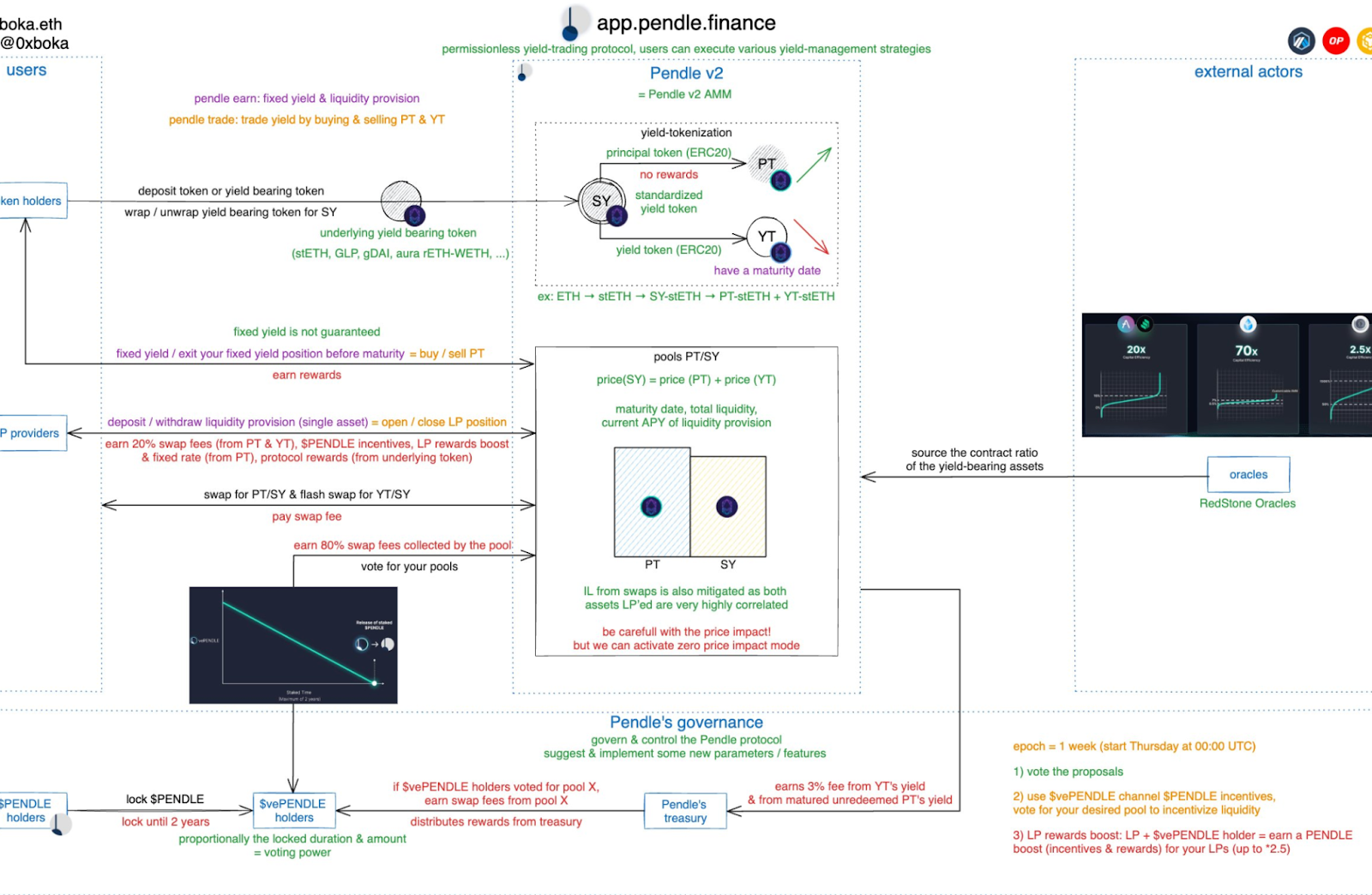

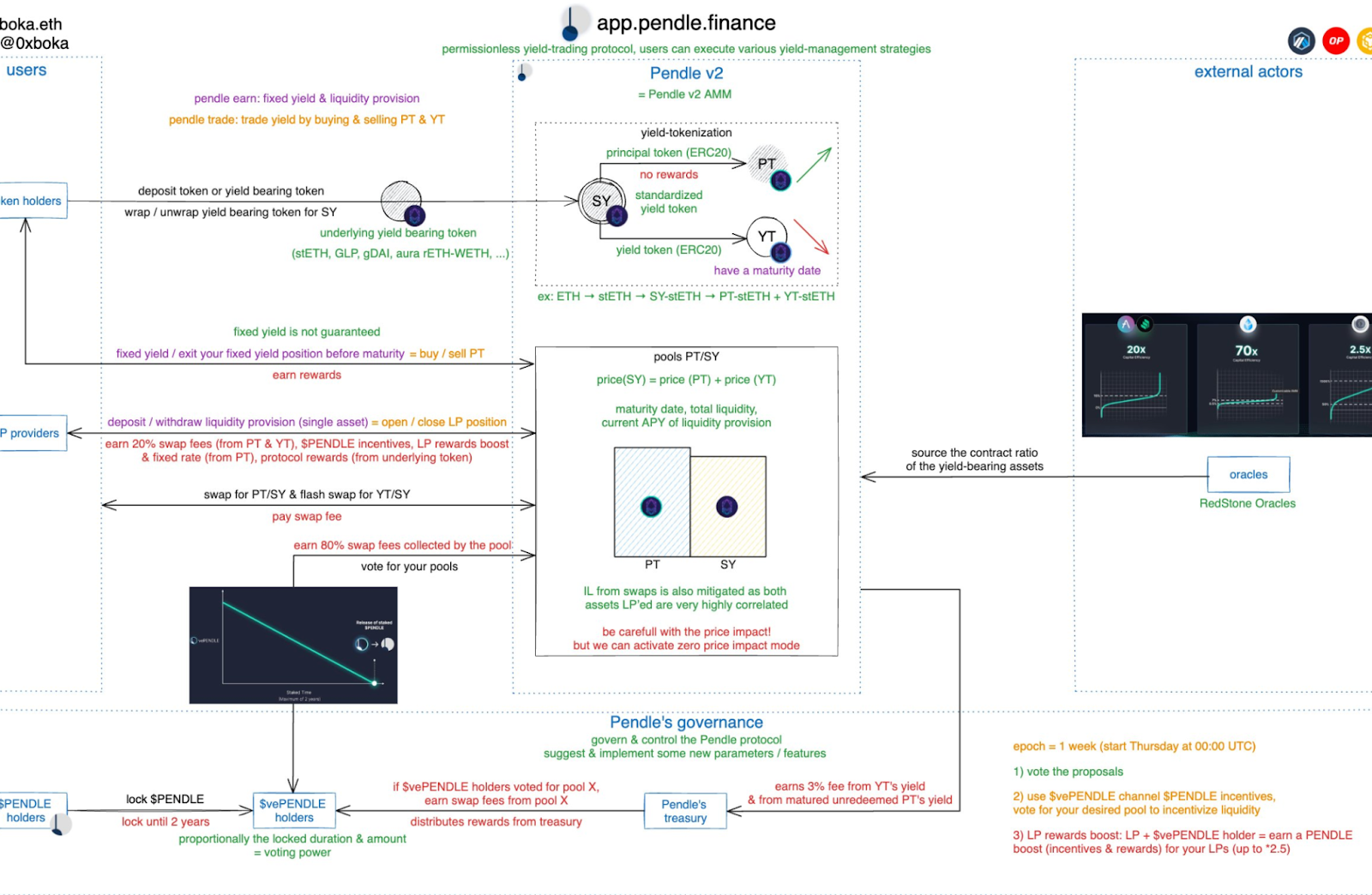

Pendle is a permissionless yield trading protocol, one that has almost been perfectly positioned for everything relevant to Eigenlayer and its vast ecosystem. Pendle has made it possible for users of Eigenlayer and various LRT protocols to sell their yield in the form of Pendle’s yield tokens (or YTs for short) and incentivized many to sell this yield in periodic fixed-rate payments to a large buyer base. While much could be written about in another report surrounding Pendle’s technical architecture, there are too many details that would need to be explained. Instead, look to this graphic and the following simple explanation to help assist you as we navigate the complexities of yield generation across different LRTs:

This graphic is quite complicated, but it’s fairly simple - users of Pendle are able to either secure fixed payments for yield tokens or speculate on the potential yield of other tokens / strategies. Pendle is not a one-size-fits-all protocol, evident through its very diverse set of strategies and the point boost programs being run through many of these protocols.

EtherFi has been able to achieve rapid success with its dual-staking approach, navigating a balance between staking demand and the huge boost in restaking demand. With Eigenlayer mainnet launching, it will be interesting to see how users react as more AVSs launch. While most LRT protocols thus far have been able to grow their TVLs and user bases thanks to yield incentives and the competitive nature of point maximization, the presence of fully live AVSs is something to watch.

Renzo

Renzo is a liquid restaking protocol that offers additional features like strategy management for AVS portfolios within the Eigenlayer ecosystem. Essentially an interface for the entire Eigenlayer ecosystem, Renzo lets users avoid the stress and simply deposit their ETH for a higher yield, with risk explicitly defined by the user - not the protocol.

The main goal of Renzo is to become the primary on / off ramp for Eigenlayer ecosystem participants, aggregating the supply into an easy-to-use interface where users make up a potentially massive demand base. Renzo archives this through the use of its novel smart contracts and node operator system, with ezETH their central liquid restaking token powering these interactions. Just like the other protocols mentioned, Renzo aggregates the market for various LSTs and lets users receive their ezETH to go out and participate in DeFi with.

Regarding Renzo’s approach to AVS management, the problem is described as a delicate balance between the potential for 1-3 AVSs under management to double-digit amounts (and a theoretical maximum of over 32,000 different combinations), making user positions increasingly subject to risk depending on the individual safety of each AVS. While most of Renzo’s users probably would not opt for extremely risky portfolios of AVSs, there is always the potential risk that rogue users attempt to take on these herculean tasks. Renzo has done significant work to better understand the latter, recognizing that in an industry as innovative and fast paced as crypto, it’s better to be prepared than to never build solutions for the inevitable.

With Eigenlayer’s mainnet launch now beginning to roll out in full force, Renzo is working on an upgrade to be pushed out by Friday April 12th that will enable the creation of AVS management positions - an exciting next step for the team as they navigate the increasingly competitive LRT market. Additionally, Renzo has been hard at work on expanding its operations cross-chain, letting users deposit on Arbitrum or Blast as well.

Puffer Finance

Building out a decentralized liquid restaking protocol, Puffer Finance has done well to amass over $1.2 billion in TVL. Puffer is a permissionless native restaking protocol that has put deposit caps in place to preserve their Ethereum alignment, avoiding any future scenarios where a restaking protocol might become too powerful for their own good with too much ETH deposited. It costs less than two ETH to run a validator on Puffer, as well as in-protocol features adding custom MEV support and hardware specifications to better shield users from slashing risk.

Users deposit ETH and receive pufETH, the native LRT of Puffer Finance, which can then be used just like standard LSTs across the DeFi ecosystem. Just like the other LRT protocols, Puffer users earn PoS staking yield and restaking rewards, with the added capital efficiency of DeFi to further increase the yield. All of this is run through a system of smart contracts powered by Puffer DAO’s RestakingModule. The contract curates a list of AVSs and desired restaking operators that manage user deposits dependent on the strategy’s condition set. Rewards flow back to stakers seamlessly, letting users focus on their individual portfolios.

Puffer has been able to carve a niche in the competitive LRT landscape by prioritizing its Ethereum alignment and commitment to collaboration. Their technology stack and protocol specifications have been made with these guiding principles in mind, giving them an edge over competitors that might enter the space and prioritize short term gains as opposed to value creating collaboration.

More recently Puffer has partnered with Balancer for users to earn 2x the points if they deposit into pufETH/stETH pool - collaborations like this are an example of just how widespread LRTs are becoming across DeFi, similar to how stETH has become completely ingrained across nearly every major DeFi protocol.

As more AVSs launch and restaking continues to absorb mindshare, it will be interesting to see how Puffer continues to build out its system of partnerships with protocols directly aligned on Puffer’s principles. Most collaborations thus far have centered around point boosting programs, but Puffer may very well take a strategy of working with a select number of AVSs that are doing their part to prioritize Ethereum alignment. For more information on Puffer and future updates, you can follow them on Twitter here.

Closing Thoughts

With so many AVSs going live and Eigenlayer’s massive reach across various DeFi sectors to-date, it’s difficult to not feel overwhelmed. There are so many types of services being powered by restaking, whether it’s trust protocols, zk coprocessors or niche modular infrastructure - Eigenlayer is enabling all of this and much more down the line.

One of the more interesting dynamics to keep an eye on will be tracking the pegs of each respective LRT, as well as their usage across various other DeFi protocols. One of the largest drivers of DeFi utility is native composability and interaction amongst the protocols that represent this industry - LRT protocols that position themselves to take advantage of this dynamic will become successful and see liquidity flow to their LRTs in time.

Another aspect worth tracking will be the strategies employed by these protocols as more AVSs launch. There will certainly be similar strategies utilized while there are only a handful of live AVSs, but it could be interesting to follow LRT protocols that target specific subsets of the broader AVS ecosystem. Maybe this comes in the form of AVSs prioritizing cross-chain composability or another group that’s focused on improving zk-technology - there are numerous possibilities and very little examples of how this might play out in the wild.

Regardless of where this narrative is headed, Eigenlayer, restaking, LRTs and AVSs are here to stay. It’s worthwhile to continue monitoring this data, keeping track of new announcements from these teams and potentially exploring these apps and their strategies for your own portfolios. If restaking continues to provide a much needed tailwind for the broader DeFi ecosystem, it would be wise to stay diligent on participating.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

The liquid staking ecosystem of Ethereum has grown to be one of the largest success stories in the DeFi sector to date. With a TVL of over $46 billion on Ethereum alone, the ability to restake your ETH and increase your capital efficiency throughout Ethereum’s DeFi ecosystem has been massively useful and one of the few examples of genuine utility occurring in the crypto industry.

Lido and Rocket Pool have led the way for years, amassing a market share of over 75% percent at the time of writing. Until recently, liquid staking had stagnated as a narrative as users had become accustomed to the utility of stETH - users began to participate heavily again after Eigenlayer, a native restaking protocol for ETH, began opening up deposits, growing to over $12 billion in TVL as of writing this.

Eigenlayer is a protocol that lets users deposit liquid staking tokens like stETH or rETH in return for restaked ETH in return, a new type of liquid staking token that lets users earn native staking yield and additional yield from Eigenlayer’s range of actively validated services (AVSs) simultaneously. With Eigenlayer having just recently launched mainnet, it’s as good of a time as any to dig in and gain an understanding of how restaking can benefit a broad AVS ecosystem and better align decentralized application security. As of writing this there are a handful of AVSs that have gone live on Eigenlayer - AltLayer’s Xterio and Mach, Lagrange, Brevis and Witness Chain. The beauty of AVSs lies in the simplicity Eigenlayer offers in spinning up a network and bootstrapping security from a reliable - and massive - pool of capital. All of these AVSs might offer entirely differentiated services, but they are all together under the umbrella of restaking provided by Eigenlayer.

The goal of this report will be to analyze not only Eigenlayer and its ambitious plans, but the host of other liquid restaking token (LRT) protocols that have been gaining traction in anticipation of the possibilities of widespread restaking. The protocols examined are three of the categorical leaders working on LRTs and additional functionality - EtherFi, Renzo and Puffer Finance. These protocols have managed to attract over $4 billion in TVL and have displayed no signs of slowing down anytime soon, with frequent collaborations and partnerships releasing every single day.

With a goal of becoming the most widely utilized and accessible restaking layer for Ethereum and beyond, Eigenlayer has been working hard to integrate more AVSs and expand its ecosystem. The architecture behind Eigenlayer can appear to be quite complicated, though it’s a lot more simple after breaking down its core parts.

At the heart of Eigenlayer is its restaking functionality, where Eigenlayer is able to gain temporary control over stETH and its accompanying security features by rewarding users with increased yields as opposed to native staking with Lido or Rocket Pool. By enabling its ecosystem of actively validated services to share in Ethereum’s robust security, Eigenlayer has essentially created a platform where protocols are able to avoid the problem of bootstrapping security and can instead focus on what truly matters - building a successful protocol.

Looking at the restaking ecosystem

There are many protocols involved in the wild west of restaking, though our focus today is only covering three of the major players offering LRTs - there will be some discussion of protocols like Pendle and the role they play in incentivizing LRTs and enabling yield generation opportunities, but this concept is far too detailed to be covered in just one section. Instead, we’ll use these protocols and Pendle as an example of what’s possible with restaking and how it might lead to a revival in DeFi.

EtherFi

EtherFi is a protocol offering decentralized liquid staking and more recently restaking via its LRT, eETH. Users can stake their ETH within EtherFi and earn staking rewards while automatically restaking that same ETH within Eigenlayer. EtherFi is a robust wrapper protocol that makes the process of restaking far easier for its users, abstracting away many of the difficulties around yield management and liquidity provision.

EtherFi has a TVL of over $3.8 billion and is the categorical liquid restaking leader currently on the market. The success of Eigenlayer sparked significant interest amongst the DeFi community thanks to Eigenlayer’s point incentivization program, adding an innovative twist to the traditional process of airdrops in crypto. For the uninformed, many crypto protocols and infrastructure providers like Uniswap, Arbitrum and Jito Labs have airdropped early users tokens in an effort to decentralize supply and reward community members.

More recently, some projects have taken to the idea of rewarding users with points prior to the actual airdrop, creating entirely new markets where users are more informed of their yield thanks to the denomination changing to a set ratio of points to capital deposited. This has led to the immense growth of DeFi protocol Pendle Finance, with its TVL having grown from $200 million at the start of 2024 to over $4.8 billion - arguably the most successful growth story of crypto since last cycle.

Pendle is a permissionless yield trading protocol, one that has almost been perfectly positioned for everything relevant to Eigenlayer and its vast ecosystem. Pendle has made it possible for users of Eigenlayer and various LRT protocols to sell their yield in the form of Pendle’s yield tokens (or YTs for short) and incentivized many to sell this yield in periodic fixed-rate payments to a large buyer base. While much could be written about in another report surrounding Pendle’s technical architecture, there are too many details that would need to be explained. Instead, look to this graphic and the following simple explanation to help assist you as we navigate the complexities of yield generation across different LRTs:

This graphic is quite complicated, but it’s fairly simple - users of Pendle are able to either secure fixed payments for yield tokens or speculate on the potential yield of other tokens / strategies. Pendle is not a one-size-fits-all protocol, evident through its very diverse set of strategies and the point boost programs being run through many of these protocols.

EtherFi has been able to achieve rapid success with its dual-staking approach, navigating a balance between staking demand and the huge boost in restaking demand. With Eigenlayer mainnet launching, it will be interesting to see how users react as more AVSs launch. While most LRT protocols thus far have been able to grow their TVLs and user bases thanks to yield incentives and the competitive nature of point maximization, the presence of fully live AVSs is something to watch.

Renzo

Renzo is a liquid restaking protocol that offers additional features like strategy management for AVS portfolios within the Eigenlayer ecosystem. Essentially an interface for the entire Eigenlayer ecosystem, Renzo lets users avoid the stress and simply deposit their ETH for a higher yield, with risk explicitly defined by the user - not the protocol.

The main goal of Renzo is to become the primary on / off ramp for Eigenlayer ecosystem participants, aggregating the supply into an easy-to-use interface where users make up a potentially massive demand base. Renzo archives this through the use of its novel smart contracts and node operator system, with ezETH their central liquid restaking token powering these interactions. Just like the other protocols mentioned, Renzo aggregates the market for various LSTs and lets users receive their ezETH to go out and participate in DeFi with.

Regarding Renzo’s approach to AVS management, the problem is described as a delicate balance between the potential for 1-3 AVSs under management to double-digit amounts (and a theoretical maximum of over 32,000 different combinations), making user positions increasingly subject to risk depending on the individual safety of each AVS. While most of Renzo’s users probably would not opt for extremely risky portfolios of AVSs, there is always the potential risk that rogue users attempt to take on these herculean tasks. Renzo has done significant work to better understand the latter, recognizing that in an industry as innovative and fast paced as crypto, it’s better to be prepared than to never build solutions for the inevitable.

With Eigenlayer’s mainnet launch now beginning to roll out in full force, Renzo is working on an upgrade to be pushed out by Friday April 12th that will enable the creation of AVS management positions - an exciting next step for the team as they navigate the increasingly competitive LRT market. Additionally, Renzo has been hard at work on expanding its operations cross-chain, letting users deposit on Arbitrum or Blast as well.

Puffer Finance

Building out a decentralized liquid restaking protocol, Puffer Finance has done well to amass over $1.2 billion in TVL. Puffer is a permissionless native restaking protocol that has put deposit caps in place to preserve their Ethereum alignment, avoiding any future scenarios where a restaking protocol might become too powerful for their own good with too much ETH deposited. It costs less than two ETH to run a validator on Puffer, as well as in-protocol features adding custom MEV support and hardware specifications to better shield users from slashing risk.

Users deposit ETH and receive pufETH, the native LRT of Puffer Finance, which can then be used just like standard LSTs across the DeFi ecosystem. Just like the other LRT protocols, Puffer users earn PoS staking yield and restaking rewards, with the added capital efficiency of DeFi to further increase the yield. All of this is run through a system of smart contracts powered by Puffer DAO’s RestakingModule. The contract curates a list of AVSs and desired restaking operators that manage user deposits dependent on the strategy’s condition set. Rewards flow back to stakers seamlessly, letting users focus on their individual portfolios.

Puffer has been able to carve a niche in the competitive LRT landscape by prioritizing its Ethereum alignment and commitment to collaboration. Their technology stack and protocol specifications have been made with these guiding principles in mind, giving them an edge over competitors that might enter the space and prioritize short term gains as opposed to value creating collaboration.

More recently Puffer has partnered with Balancer for users to earn 2x the points if they deposit into pufETH/stETH pool - collaborations like this are an example of just how widespread LRTs are becoming across DeFi, similar to how stETH has become completely ingrained across nearly every major DeFi protocol.

As more AVSs launch and restaking continues to absorb mindshare, it will be interesting to see how Puffer continues to build out its system of partnerships with protocols directly aligned on Puffer’s principles. Most collaborations thus far have centered around point boosting programs, but Puffer may very well take a strategy of working with a select number of AVSs that are doing their part to prioritize Ethereum alignment. For more information on Puffer and future updates, you can follow them on Twitter here.

Closing Thoughts

With so many AVSs going live and Eigenlayer’s massive reach across various DeFi sectors to-date, it’s difficult to not feel overwhelmed. There are so many types of services being powered by restaking, whether it’s trust protocols, zk coprocessors or niche modular infrastructure - Eigenlayer is enabling all of this and much more down the line.

One of the more interesting dynamics to keep an eye on will be tracking the pegs of each respective LRT, as well as their usage across various other DeFi protocols. One of the largest drivers of DeFi utility is native composability and interaction amongst the protocols that represent this industry - LRT protocols that position themselves to take advantage of this dynamic will become successful and see liquidity flow to their LRTs in time.

Another aspect worth tracking will be the strategies employed by these protocols as more AVSs launch. There will certainly be similar strategies utilized while there are only a handful of live AVSs, but it could be interesting to follow LRT protocols that target specific subsets of the broader AVS ecosystem. Maybe this comes in the form of AVSs prioritizing cross-chain composability or another group that’s focused on improving zk-technology - there are numerous possibilities and very little examples of how this might play out in the wild.

Regardless of where this narrative is headed, Eigenlayer, restaking, LRTs and AVSs are here to stay. It’s worthwhile to continue monitoring this data, keeping track of new announcements from these teams and potentially exploring these apps and their strategies for your own portfolios. If restaking continues to provide a much needed tailwind for the broader DeFi ecosystem, it would be wise to stay diligent on participating.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

The liquid staking ecosystem of Ethereum has grown to be one of the largest success stories in the DeFi sector to date. With a TVL of over $46 billion on Ethereum alone, the ability to restake your ETH and increase your capital efficiency throughout Ethereum’s DeFi ecosystem has been massively useful and one of the few examples of genuine utility occurring in the crypto industry.

Lido and Rocket Pool have led the way for years, amassing a market share of over 75% percent at the time of writing. Until recently, liquid staking had stagnated as a narrative as users had become accustomed to the utility of stETH - users began to participate heavily again after Eigenlayer, a native restaking protocol for ETH, began opening up deposits, growing to over $12 billion in TVL as of writing this.

Eigenlayer is a protocol that lets users deposit liquid staking tokens like stETH or rETH in return for restaked ETH in return, a new type of liquid staking token that lets users earn native staking yield and additional yield from Eigenlayer’s range of actively validated services (AVSs) simultaneously. With Eigenlayer having just recently launched mainnet, it’s as good of a time as any to dig in and gain an understanding of how restaking can benefit a broad AVS ecosystem and better align decentralized application security. As of writing this there are a handful of AVSs that have gone live on Eigenlayer - AltLayer’s Xterio and Mach, Lagrange, Brevis and Witness Chain. The beauty of AVSs lies in the simplicity Eigenlayer offers in spinning up a network and bootstrapping security from a reliable - and massive - pool of capital. All of these AVSs might offer entirely differentiated services, but they are all together under the umbrella of restaking provided by Eigenlayer.

The goal of this report will be to analyze not only Eigenlayer and its ambitious plans, but the host of other liquid restaking token (LRT) protocols that have been gaining traction in anticipation of the possibilities of widespread restaking. The protocols examined are three of the categorical leaders working on LRTs and additional functionality - EtherFi, Renzo and Puffer Finance. These protocols have managed to attract over $4 billion in TVL and have displayed no signs of slowing down anytime soon, with frequent collaborations and partnerships releasing every single day.

With a goal of becoming the most widely utilized and accessible restaking layer for Ethereum and beyond, Eigenlayer has been working hard to integrate more AVSs and expand its ecosystem. The architecture behind Eigenlayer can appear to be quite complicated, though it’s a lot more simple after breaking down its core parts.

At the heart of Eigenlayer is its restaking functionality, where Eigenlayer is able to gain temporary control over stETH and its accompanying security features by rewarding users with increased yields as opposed to native staking with Lido or Rocket Pool. By enabling its ecosystem of actively validated services to share in Ethereum’s robust security, Eigenlayer has essentially created a platform where protocols are able to avoid the problem of bootstrapping security and can instead focus on what truly matters - building a successful protocol.

Looking at the restaking ecosystem

There are many protocols involved in the wild west of restaking, though our focus today is only covering three of the major players offering LRTs - there will be some discussion of protocols like Pendle and the role they play in incentivizing LRTs and enabling yield generation opportunities, but this concept is far too detailed to be covered in just one section. Instead, we’ll use these protocols and Pendle as an example of what’s possible with restaking and how it might lead to a revival in DeFi.

EtherFi

EtherFi is a protocol offering decentralized liquid staking and more recently restaking via its LRT, eETH. Users can stake their ETH within EtherFi and earn staking rewards while automatically restaking that same ETH within Eigenlayer. EtherFi is a robust wrapper protocol that makes the process of restaking far easier for its users, abstracting away many of the difficulties around yield management and liquidity provision.

EtherFi has a TVL of over $3.8 billion and is the categorical liquid restaking leader currently on the market. The success of Eigenlayer sparked significant interest amongst the DeFi community thanks to Eigenlayer’s point incentivization program, adding an innovative twist to the traditional process of airdrops in crypto. For the uninformed, many crypto protocols and infrastructure providers like Uniswap, Arbitrum and Jito Labs have airdropped early users tokens in an effort to decentralize supply and reward community members.

More recently, some projects have taken to the idea of rewarding users with points prior to the actual airdrop, creating entirely new markets where users are more informed of their yield thanks to the denomination changing to a set ratio of points to capital deposited. This has led to the immense growth of DeFi protocol Pendle Finance, with its TVL having grown from $200 million at the start of 2024 to over $4.8 billion - arguably the most successful growth story of crypto since last cycle.

Pendle is a permissionless yield trading protocol, one that has almost been perfectly positioned for everything relevant to Eigenlayer and its vast ecosystem. Pendle has made it possible for users of Eigenlayer and various LRT protocols to sell their yield in the form of Pendle’s yield tokens (or YTs for short) and incentivized many to sell this yield in periodic fixed-rate payments to a large buyer base. While much could be written about in another report surrounding Pendle’s technical architecture, there are too many details that would need to be explained. Instead, look to this graphic and the following simple explanation to help assist you as we navigate the complexities of yield generation across different LRTs:

This graphic is quite complicated, but it’s fairly simple - users of Pendle are able to either secure fixed payments for yield tokens or speculate on the potential yield of other tokens / strategies. Pendle is not a one-size-fits-all protocol, evident through its very diverse set of strategies and the point boost programs being run through many of these protocols.

EtherFi has been able to achieve rapid success with its dual-staking approach, navigating a balance between staking demand and the huge boost in restaking demand. With Eigenlayer mainnet launching, it will be interesting to see how users react as more AVSs launch. While most LRT protocols thus far have been able to grow their TVLs and user bases thanks to yield incentives and the competitive nature of point maximization, the presence of fully live AVSs is something to watch.

Renzo

Renzo is a liquid restaking protocol that offers additional features like strategy management for AVS portfolios within the Eigenlayer ecosystem. Essentially an interface for the entire Eigenlayer ecosystem, Renzo lets users avoid the stress and simply deposit their ETH for a higher yield, with risk explicitly defined by the user - not the protocol.

The main goal of Renzo is to become the primary on / off ramp for Eigenlayer ecosystem participants, aggregating the supply into an easy-to-use interface where users make up a potentially massive demand base. Renzo archives this through the use of its novel smart contracts and node operator system, with ezETH their central liquid restaking token powering these interactions. Just like the other protocols mentioned, Renzo aggregates the market for various LSTs and lets users receive their ezETH to go out and participate in DeFi with.

Regarding Renzo’s approach to AVS management, the problem is described as a delicate balance between the potential for 1-3 AVSs under management to double-digit amounts (and a theoretical maximum of over 32,000 different combinations), making user positions increasingly subject to risk depending on the individual safety of each AVS. While most of Renzo’s users probably would not opt for extremely risky portfolios of AVSs, there is always the potential risk that rogue users attempt to take on these herculean tasks. Renzo has done significant work to better understand the latter, recognizing that in an industry as innovative and fast paced as crypto, it’s better to be prepared than to never build solutions for the inevitable.

With Eigenlayer’s mainnet launch now beginning to roll out in full force, Renzo is working on an upgrade to be pushed out by Friday April 12th that will enable the creation of AVS management positions - an exciting next step for the team as they navigate the increasingly competitive LRT market. Additionally, Renzo has been hard at work on expanding its operations cross-chain, letting users deposit on Arbitrum or Blast as well.

Puffer Finance

Building out a decentralized liquid restaking protocol, Puffer Finance has done well to amass over $1.2 billion in TVL. Puffer is a permissionless native restaking protocol that has put deposit caps in place to preserve their Ethereum alignment, avoiding any future scenarios where a restaking protocol might become too powerful for their own good with too much ETH deposited. It costs less than two ETH to run a validator on Puffer, as well as in-protocol features adding custom MEV support and hardware specifications to better shield users from slashing risk.

Users deposit ETH and receive pufETH, the native LRT of Puffer Finance, which can then be used just like standard LSTs across the DeFi ecosystem. Just like the other LRT protocols, Puffer users earn PoS staking yield and restaking rewards, with the added capital efficiency of DeFi to further increase the yield. All of this is run through a system of smart contracts powered by Puffer DAO’s RestakingModule. The contract curates a list of AVSs and desired restaking operators that manage user deposits dependent on the strategy’s condition set. Rewards flow back to stakers seamlessly, letting users focus on their individual portfolios.

Puffer has been able to carve a niche in the competitive LRT landscape by prioritizing its Ethereum alignment and commitment to collaboration. Their technology stack and protocol specifications have been made with these guiding principles in mind, giving them an edge over competitors that might enter the space and prioritize short term gains as opposed to value creating collaboration.

More recently Puffer has partnered with Balancer for users to earn 2x the points if they deposit into pufETH/stETH pool - collaborations like this are an example of just how widespread LRTs are becoming across DeFi, similar to how stETH has become completely ingrained across nearly every major DeFi protocol.

As more AVSs launch and restaking continues to absorb mindshare, it will be interesting to see how Puffer continues to build out its system of partnerships with protocols directly aligned on Puffer’s principles. Most collaborations thus far have centered around point boosting programs, but Puffer may very well take a strategy of working with a select number of AVSs that are doing their part to prioritize Ethereum alignment. For more information on Puffer and future updates, you can follow them on Twitter here.

Closing Thoughts

With so many AVSs going live and Eigenlayer’s massive reach across various DeFi sectors to-date, it’s difficult to not feel overwhelmed. There are so many types of services being powered by restaking, whether it’s trust protocols, zk coprocessors or niche modular infrastructure - Eigenlayer is enabling all of this and much more down the line.

One of the more interesting dynamics to keep an eye on will be tracking the pegs of each respective LRT, as well as their usage across various other DeFi protocols. One of the largest drivers of DeFi utility is native composability and interaction amongst the protocols that represent this industry - LRT protocols that position themselves to take advantage of this dynamic will become successful and see liquidity flow to their LRTs in time.

Another aspect worth tracking will be the strategies employed by these protocols as more AVSs launch. There will certainly be similar strategies utilized while there are only a handful of live AVSs, but it could be interesting to follow LRT protocols that target specific subsets of the broader AVS ecosystem. Maybe this comes in the form of AVSs prioritizing cross-chain composability or another group that’s focused on improving zk-technology - there are numerous possibilities and very little examples of how this might play out in the wild.

Regardless of where this narrative is headed, Eigenlayer, restaking, LRTs and AVSs are here to stay. It’s worthwhile to continue monitoring this data, keeping track of new announcements from these teams and potentially exploring these apps and their strategies for your own portfolios. If restaking continues to provide a much needed tailwind for the broader DeFi ecosystem, it would be wise to stay diligent on participating.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.